IR

IREarnings & Financial Highlights

-

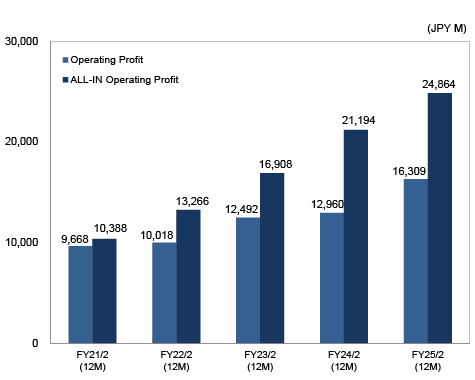

1Operating Profit & All-In Operating Profit

Ichigo conducts value-add on SRE (Sustainable Real Estate) assets regardless of whether they are classified in accounting terms as either Real Estate for Sale or Fixed Assets, and generates both stock earnings (rental income) and flow earnings via asset sales. Because gains on sales of value-add assets that are classified as Fixed Assets are accounted for as Extraordinary Gains and not reflected in Operating Profit, All-In Operating Profit, which includes these gains on sales, represents SRE’s actual profit contribution.

All-In Operating Profit = Operating Profit + SRE Extraordinary Gains on Sales -

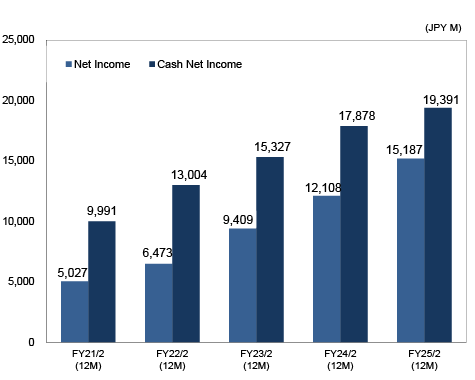

2Net Income & Cash Net Income

Cash flow generation is Ichigo’s most important business priority. The ability to generate cash underpins profitability. Ichigo drives shareholder value growth via robust cash flows that fund both growth investments and shareholder returns. Due to its focus on cash flow generation, Ichigo sets cash-based KPIs.

Cash Net Income = Net Income + Depreciation + Amortization +/- Valuation Losses (Gains) -

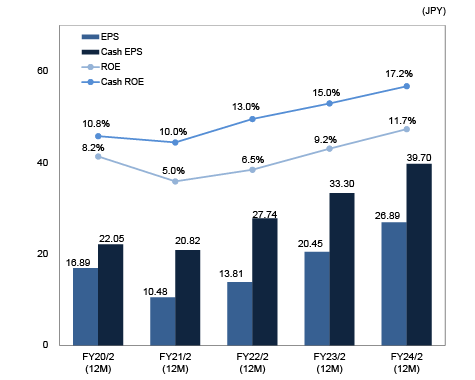

3Earnings Per Share (EPS), Cash EPS, Return on Equity (ROE), & Cash ROE

Cash EPS is a fundamental metric of shareholder value. Ichigo works to grow shareholder value via generating robust cash flows that fund both growth investments and shareholder returns. Ichigo emphasizes Cash ROE as a measure of capital efficiency due to Ichigo’s focus on cash profit (economic profit).

Cash EPS=Cash Net Income/Average Number of Shares Outstanding in the Fiscal Year

Cash ROE=Cash Net Income/Shareholders’ Equity -

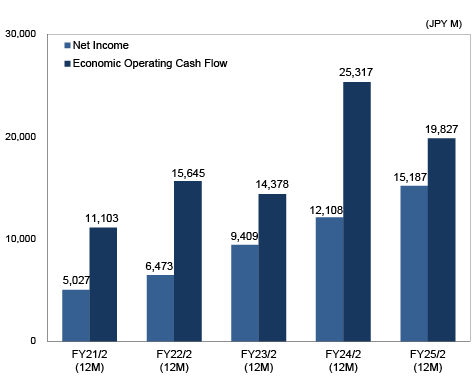

4Net Income & Economic Operating Cash Flow

Ichigo’s Net Income (accounting profit) consistently exceeds its cash flows. Ichigo uses Economic Operating Cash Flow as a KPI because accounting profit does not necessarily equal cash flow generation and the ability to generate cash underpins profitability.

Economic Operating Cash Flow is Cash Flows from Operations, excluding net change in Real Estate and Power Plants for Sale, plus post-tax gains on sales of SRE assets recorded as extraordinary gains. -

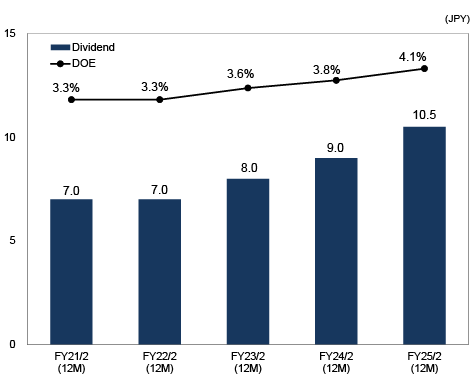

5Dividend & DOE (Dividend on Equity)

In FY17/2 Ichigo implemented a progressive dividend policy, under which Ichigo’s dividend is maintained or raised every year, but not cut. Ichigo uses a DOE payout ratio in its shareholder return policy and increased its DOE payout ratio from 3% to 4% in FY25/2. Ichigo works to maximize shareholder value via a shareholder distribution policy that focuses on dividend durability, certainty, and growth.

-

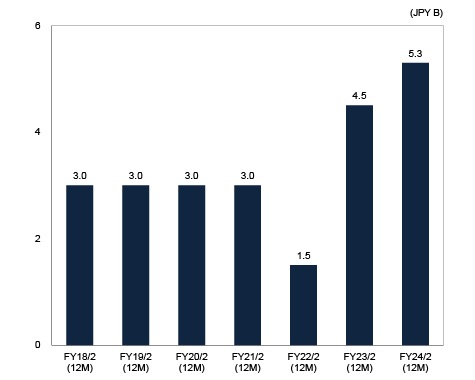

6Share Buybacks

In its Ichigo 2030 vision Ichigo adopted a policy to flexibly conduct share buybacks to optimize its capital structure and drive growth in shareholder value. Ichigo conducts share buybacks based on a comprehensive assessment of its cash flow generation and financial standing and Ichigo’s share price. As of FY24/2, Ichigo has conducted share buybacks for 7 consecutive years.

-

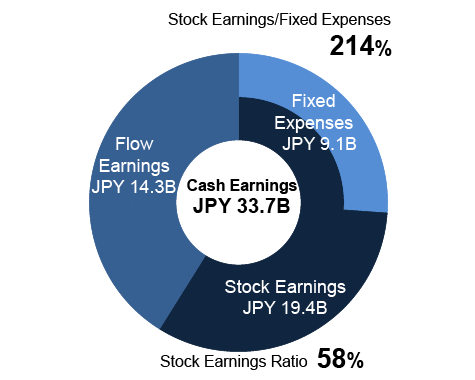

7Stock Earnings Ratio & Stock Earnings/Fixed Expenses Ratio

As part of its Ichigo 2030 vision Ichigo is targeting a Stock Earnings Ratio of 60% and a Stock Earnings/Fixed Expenses Ratio of 200%. Leveraging its core value-add capabilities, Ichigo is working to both grow its earnings and strengthen the sustainability and durability of its earnings, generating new earnings streams that are less sensitive to changes in real estate market conditions.

Stock Earnings: Rental Income, Power Generation Revenues, Base AM Fees

Fixed Expenses: Fixed SG&A + Interest Expenses -

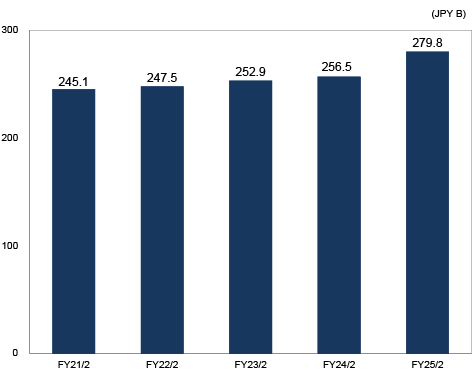

8Ichigo-Owned Assets (Real Estate) Outstanding

Ichigo’s Sustainable Real Estate Business preserves and improves real estate. Ichigo generates stock earnings (rental income) while owning assets, and generates profit from assets for which value-add has been completed. Ichigo invested JPY 69.5 billion in asset acquisitions and recorded JPY 69.6 billion in asset sales in FY24/2, continuing to make growth investments to drive growth in shareholder value.

-

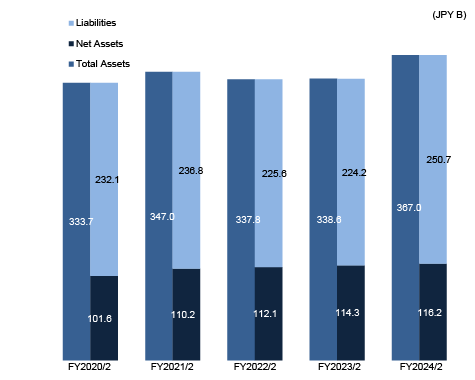

9Balance Sheet

Executing on its focus to maximize shareholder value via robust cash flow generation, Ichigo has been accelerating growth investments that are driving higher earnings, thus enhancing its balance sheet while maintaining its soundness through the acquisitions of quality assets with Ichigo’s favorable borrowing terms. Shareholders' equity based on the Pro Forma Balance Sheet adjusted to remove risks not attributable to Ichigo is 43.6% including unrealized gains as of February 29, 2024.

-

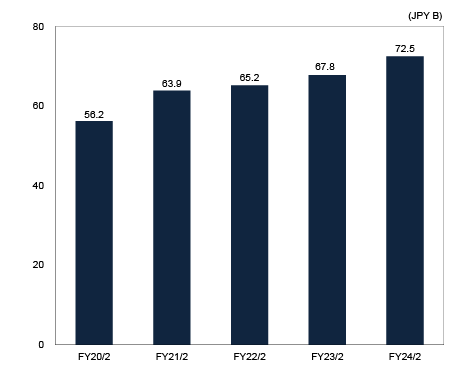

10Third-Party Appraisal Value-Based Unrealized Gains

Ichigo pro-actively buys and sells real estate assets within its SRE business, selling assets that it has improved via its sustainable value-add and investing the proceeds to acquire real estate assets that will benefit from Ichigo’s value-add. While third-party appraisal value-based unrealized gains are not recognized as accounting profits, they are an earnings bank that drive forward earnings. When these assets are sold after Ichigo’s value-add, Ichigo generally generates profits that are roughly twice the unrealized gains estimated via third-party appraisals.