Business

Business

ESG & SDGs Finance

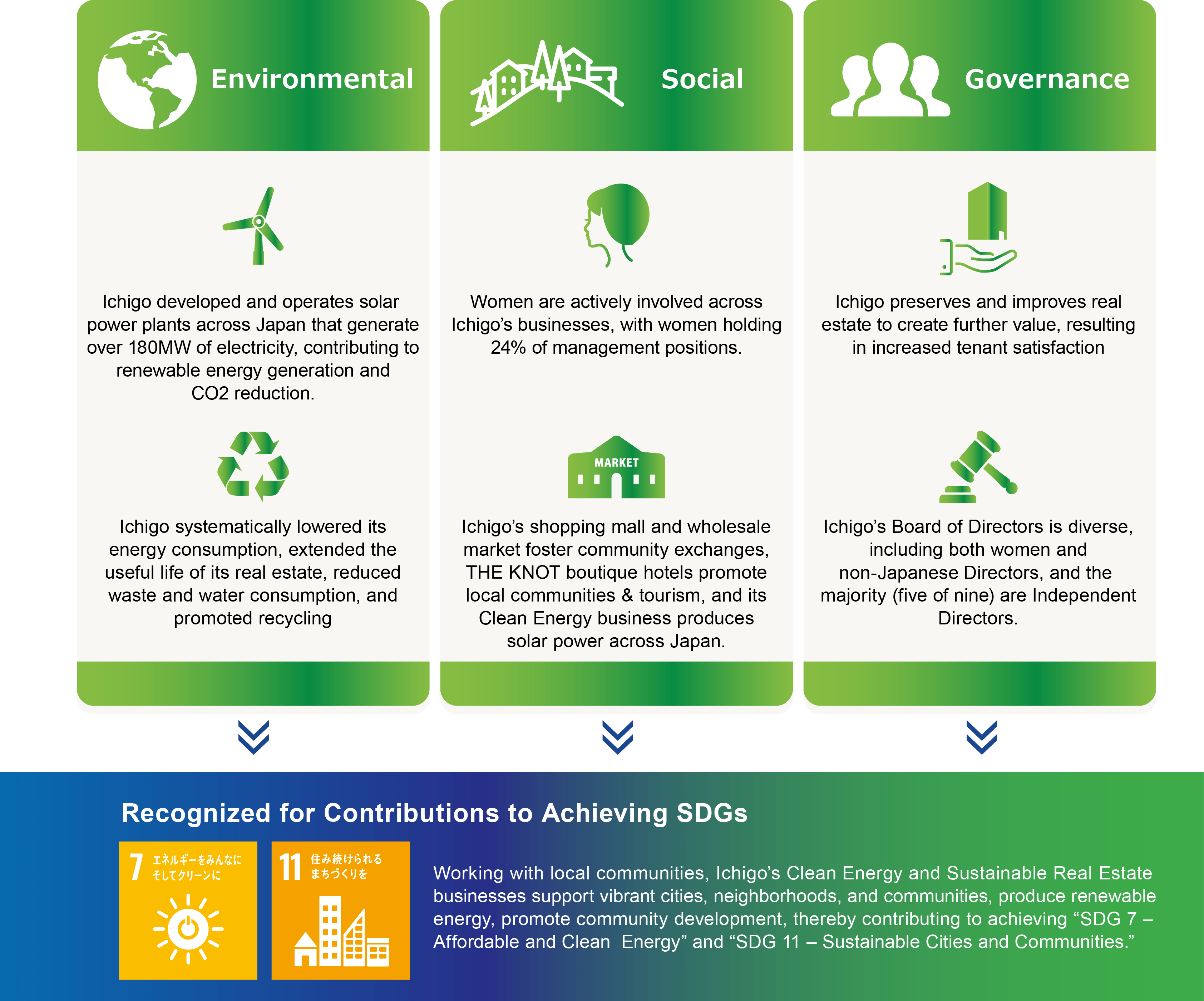

Ichigo is a Japanese sustainable infrastructure company dedicated to making the world more sustainable. In keeping with its Ichigo 2030 vision, Ichigo is expanding the scope of its real estate and clean energy businesses to further contribute to a sustainable society and grow long-term value for its shareholders.

In September 2020, Ichigo borrowed funds via Sumitomo Mitsui Banking Corporation’s (“SMBC”) ESG/SDGs syndicated loan program (“ESG/SDGs Finance”) based on the United Nations (“UN”) Principles for Positive Impact Finance. Ichigo is the first Japanese real estate company to borrow from the ESG/SDGs Loan.

SMBC recognized Ichigo’s outstanding ESG initiatives and disclosures and its ambition to contribute to achieving the SDGs via its business activities. It therefore awarded Ichigo the second highest ESG/SDGs rank in its rating system. SMBC particularly recognized Ichigo for “Reducing Environmental Impacts through Products & Services,” “Consideration for Local & Global Communities,” and “Commitment to Corporate Values & Sustainability.”

In September 2020, Ichigo borrowed funds via Sumitomo Mitsui Banking Corporation’s (“SMBC”) ESG/SDGs syndicated loan program (“ESG/SDGs Finance”) based on the United Nations (“UN”) Principles for Positive Impact Finance. Ichigo is the first Japanese real estate company to borrow from the ESG/SDGs Loan.

SMBC recognized Ichigo’s outstanding ESG initiatives and disclosures and its ambition to contribute to achieving the SDGs via its business activities. It therefore awarded Ichigo the second highest ESG/SDGs rank in its rating system. SMBC particularly recognized Ichigo for “Reducing Environmental Impacts through Products & Services,” “Consideration for Local & Global Communities,” and “Commitment to Corporate Values & Sustainability.”

*UN Principles for Positive Impact Finance

The UN Principles for Positive Impact Finance is a financial framework established by the United Nations Environment Programme Finance Initiative (“UNEP FI” ) in January 2017 as a principle for financial institutions to fund businesses that contribute to achieving the SDGs. It is comprised of four principles: Definition, Frameworks, Transparency, and Assessment, and defines a structure for financing aimed to mitigate the negative impacts and systematically and sustainably increase the positive impacts of a borrowing company’s activities.