IR

IREarnings & Financial Highlights

-

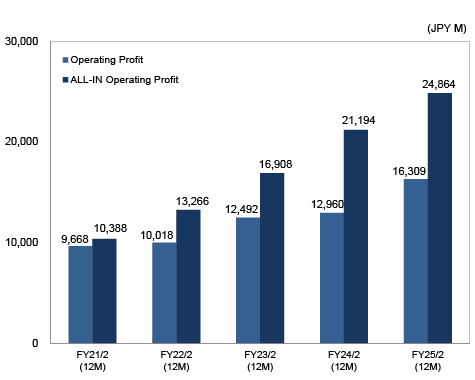

1Operating Profit & All-In Operating Profit

Ichigo conducts value-add on SRE (Sustainable Real Estate)/Hotel assets regardless of whether they are classified in accounting terms as Real Estate for Sale or Fixed Assets, and generates both stock earnings (rental income) and flow earnings via asset sales. Because Fixed Assets Gains on Sales for value-add assets are accounted for as Extraordinary Gains and not reflected in Operating Profit, the All-In Operating Profit represent SRE/Hotel’s actual profit contribution.

All-In Operating Profit = Operating Profit + SRE/Hotel Extraordinary Gains on Sales -

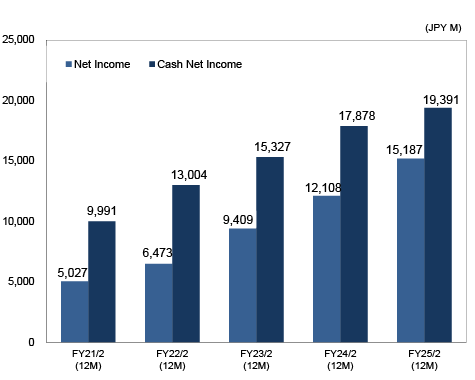

2Net Income & Cash Net Income

Cash flow generation is an important business priority. The ability to generate cash underpins profitability, and Ichigo is maximizing shareholder value via robust cash flows that fund both growth investments and shareholder returns. Basesd on its focus on cash flow generation, Ichigo sets cash-based KPIs.

Cash Net Income = Net Income + Depreciation + Amortization +/- Valuation Losses (Gains) -

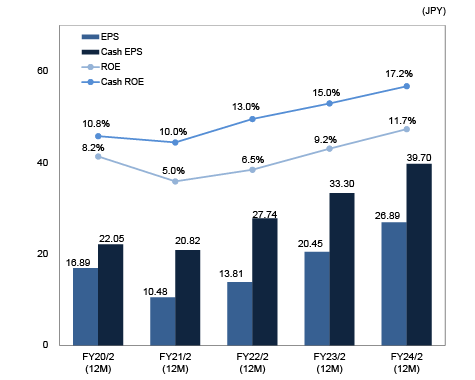

3Earnings Per Share (EPS), Cash EPS, Return on Equity (ROE), & Cash ROE

Cash EPS is an important metric of shareholder value, and Ichigo is maximizing shareholder value via robust cash flows that fund both growth investments and shareholder returns. Ichigo uses Cash ROE, an indicator of ROE, which measures a company's capital efficiency, based on economic profit.

Cash EPS=Cash Net Income/Average Number of Shares Outstanding in the Fiscal Year

Cash ROE=Cash Net Income/Shareholders’ Equity -

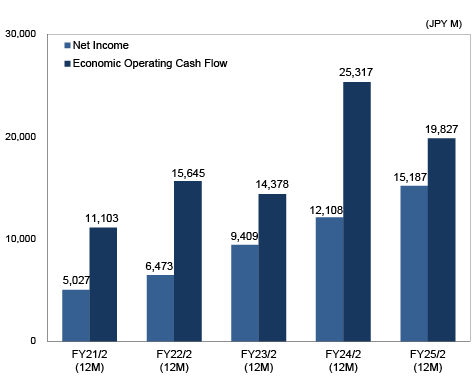

4Net Income & Economic Operating Cash Flow

Ichigo uses Economic Operating Cash Flow as a KPI because accounting profit does not necessarily equal cash flow generation and the ability to generate cash underpins profitability. Ichigo’s Economic Operating Cash Flow consistently exceeds Net Income (accounting profit).

Economic Operating Cash Flow is Cash Flows from Operations, excluding net change in Real Estate and Power Plants for Sale, plus post-tax gains on sales of SRE assets recorded as extraordinary gains. -

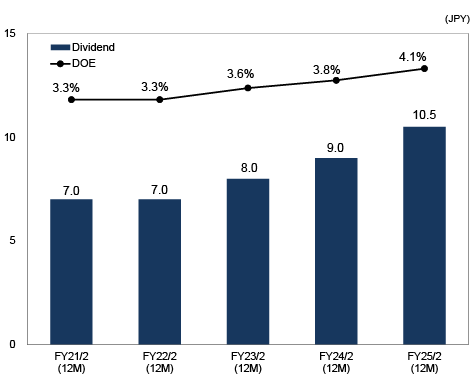

5Dividend & DOE (Dividend on Equity)

In FY17/2 Ichigo implemented a progressive dividend policy, under which Ichigo’s dividend is maintained or raised every year, but not cut. Ichigo uses a DOE payout ratio in its shareholder return policy and increased its DOE payout ratio from 3% to 4% in April 2024. Ichigo seeks to maximize shareholder value via a shareholder distribution policy that focuses on dividend durability growth, durability, and certainty.

-

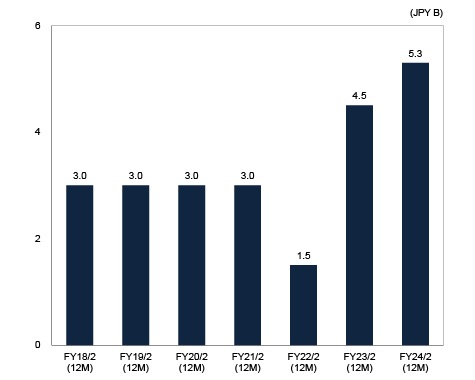

6Share Buybacks

Ichigo adopted a policy to flexibly conduct share buybacks under its Ichigo 2030 vision to optimize its capital structure and drive shareholder value. Ichigo will conduct share buybacks based on a comprehensive assessment of its cash flow generation, the market price of Ichigo’s shares, and Ichigo’s financial standing. Ichigo has conducted share buybacks for 8 consecutive years as of FY25/2.

-

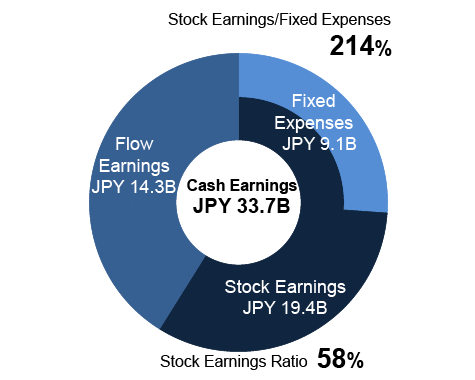

7Stock Earnings Ratio & Stock Earnings/Fixed Expenses Ratio

Ichigo is targeting a Stock Earnings Ratio of 60% and a Stock Earnings/Fixed Expenses Ratio of 200% in its Ichigo 2030 vision. Leveraging its core value-add capabilities, Ichigo is working to grow both its earnings and strengthen the sustainability and durability of its earnings, generating new earnings streams that are less sensitive to changes in real estate market conditions.

Stock Earnings: Rental Income, Power Generation Revenues, Base AM Fees

Fixed Expenses: Fixed SG&A + Interest Expenses -

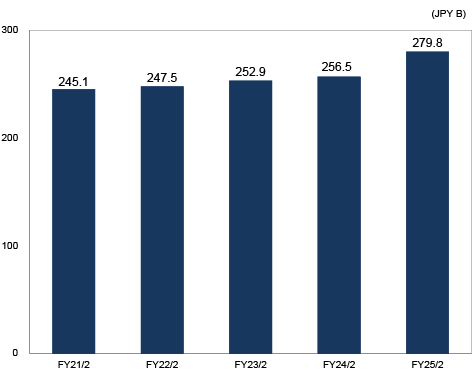

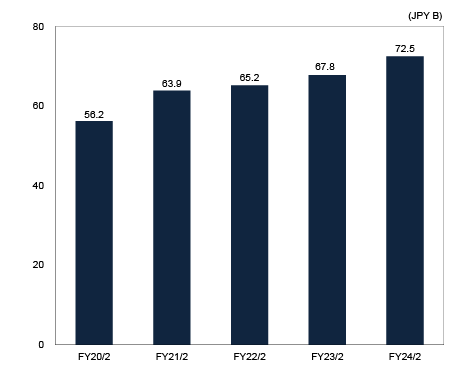

8Ichigo-Owned Assets (Real Estate) Outstanding

Ichigo’s Sustainable Real Estate and Hotel Businesses preserve and improve existing real estate to increase the value of assets. Ichigo generates stock earnings (rental income) while owning assets, and generates profit from assets for which value-add has been completed. Ichigo invested JPY 75.4 billion in asset acquisitions and recorded JPY 64.8 billion in asset sales in FY25/2, and is continuing to make growth investments.

-

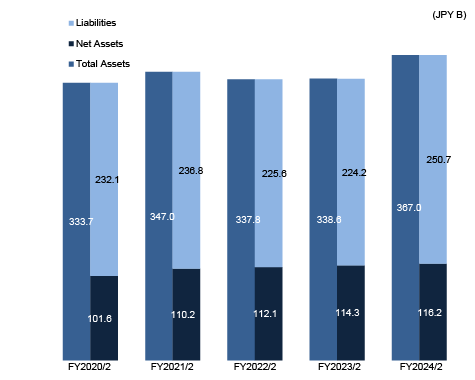

9Balance Sheet

Executing on its focus to maximize shareholder value via robust cash flow generation, Ichigo has been accelerating growth investments by taking advantage of the upturns in the real estate and financial markets, thus enhancing its balance sheet while maintaining its soundness through the acquisitions of quality assets and favorable loans.

Shareholders' equity based on the Pro Forma Balance Sheet adjusted to remove risks not attributable to Ichigo is 40.6% including unrealized gains as of February 28, 2025. -

10Third-Party Appraisal Value-Based Unrealized Gains

Ichigo conducts selective asset sales and acquisitions under its SRE business, selling assets that have been improved via its Sustainable Value-Add while also newly investing in real estate assets. Although third-party appraisal value-based unrealized gains are not recognized as accounting profits, they are an earnings bank for future periods, and when assets are sold, Ichigo record profits that are roughly twice unrealized gains.